The Virginia Department of Taxation plays a pivotal role in the financial ecosystem of the Commonwealth. As one of the most crucial state agencies, it manages tax-related matters for individuals and businesses. Whether you're a resident or a business owner, understanding this department's responsibilities and functions is essential to ensure compliance and avoid penalties.

Taxes are an integral part of every economy, and the VA Department of Taxation ensures that state revenue is collected efficiently and fairly. This department handles a wide range of tax types, including income tax, sales tax, and excise tax. Its mission is to provide clarity and transparency to taxpayers while ensuring that the funds collected contribute to the welfare of the community.

This article aims to provide a detailed overview of the VA Department of Taxation, its functions, and the resources available to taxpayers. Whether you're looking for information on filing your taxes, understanding tax credits, or navigating the appeals process, this guide will serve as a valuable resource for all your tax-related queries.

Read also:Girth Master Vs Miaz Video A Comprehensive Analysis And Comparison

Table of Contents

- Introduction to the VA Department of Taxation

- History of the Department

- Key Responsibilities

- Types of Taxes Managed

- Resources for Taxpayers

- Filing Process Explained

- Appeals and Dispute Resolution

- Understanding Tax Credits

- Common Questions Answered

- Future of the VA Department of Taxation

Introduction to the VA Department of Taxation

The VA Department of Taxation is responsible for administering state tax laws and ensuring that all taxpayers comply with their obligations. Established to streamline tax collection and enforcement, the department plays a critical role in generating revenue for the Commonwealth of Virginia. Its primary goal is to provide taxpayers with the tools and information they need to file their taxes accurately and efficiently.

Core Mission and Vision

The mission of the VA Department of Taxation is to foster a fair and transparent tax system that benefits all Virginians. By maintaining a high level of accountability, the department aims to build trust with taxpayers and ensure that the funds collected are used wisely for public services. The vision is to create a modern, efficient, and taxpayer-friendly environment that simplifies the tax filing process.

History of the Department

The VA Department of Taxation has a long and storied history, dating back to the early days of the Commonwealth. Over the years, it has evolved to meet the changing needs of taxpayers and the state's economy. From manual record-keeping to advanced digital systems, the department has embraced technology to improve its services.

Key Milestones

- Establishment of the first state tax office in the early 1900s.

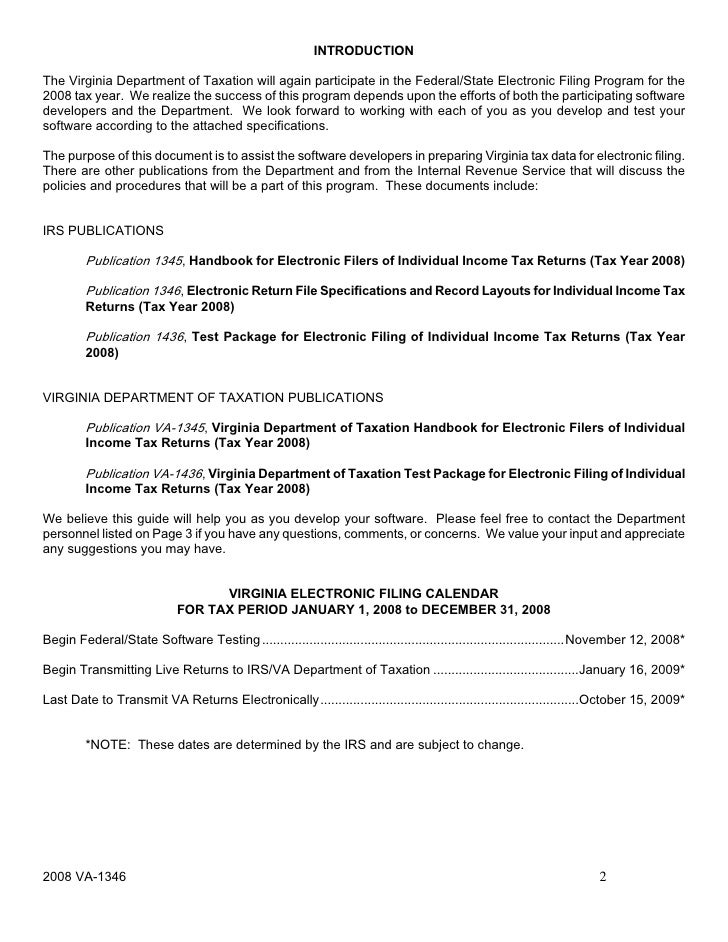

- Introduction of electronic filing in the 1990s.

- Expansion of online resources and mobile applications in the 2010s.

Key Responsibilities

The VA Department of Taxation handles a wide range of responsibilities, ensuring that all tax-related matters are addressed promptly and effectively. These responsibilities include tax collection, enforcement, and education.

Tax Collection

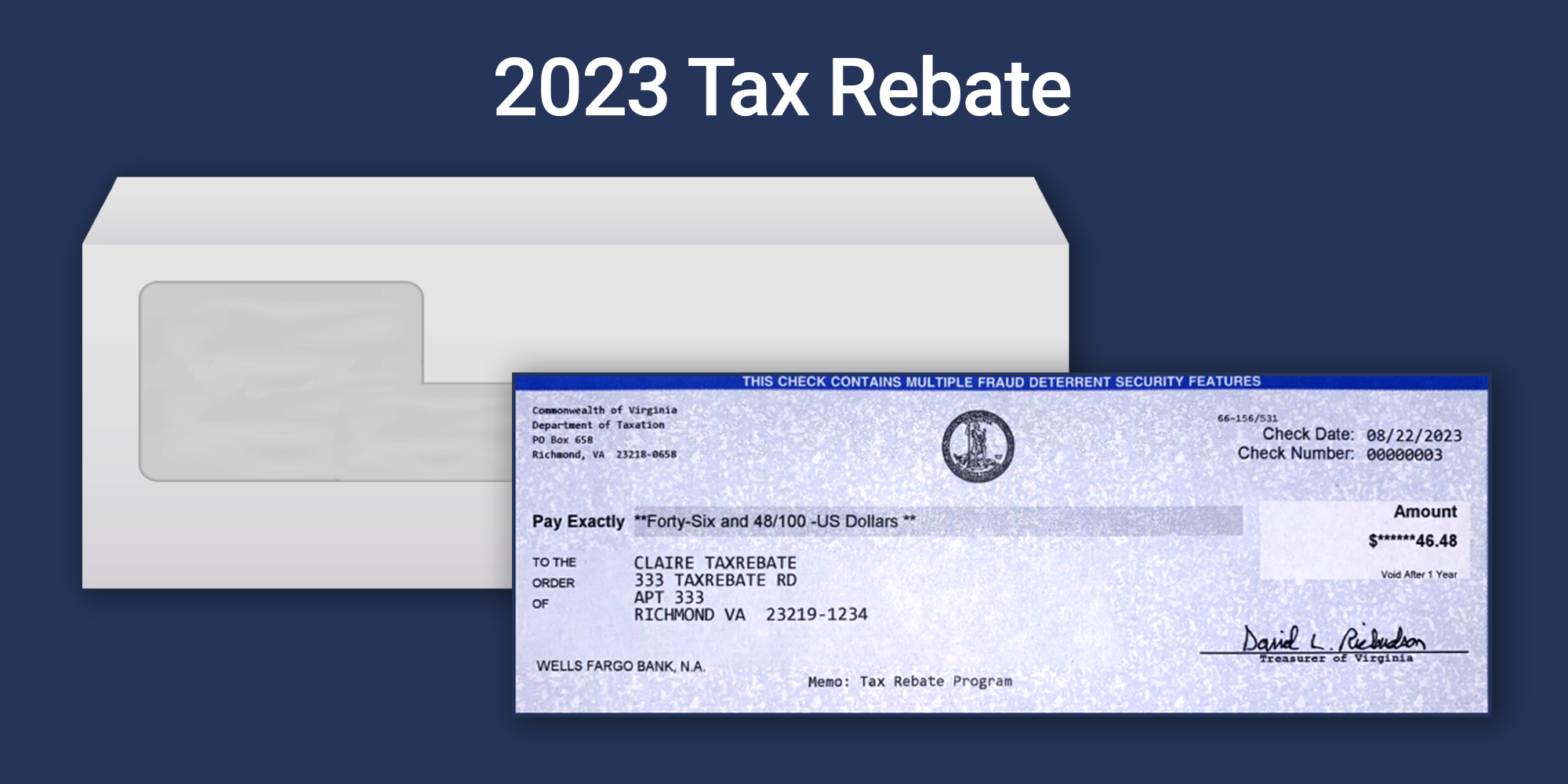

One of the primary functions of the department is to collect taxes from individuals and businesses. This includes processing tax returns, issuing refunds, and managing payment plans for taxpayers who owe money.

Tax Enforcement

To ensure compliance, the department employs various enforcement strategies, such as audits and penalties for late or incorrect filings. These measures help maintain the integrity of the tax system and protect the interests of all taxpayers.

Read also:Unveiling The Potential Of Masahubin A Comprehensive Guide

Types of Taxes Managed

The VA Department of Taxation oversees several types of taxes, each with its own set of rules and regulations. Understanding these tax categories is essential for taxpayers to meet their obligations.

Income Tax

Income tax is levied on the earnings of individuals and businesses. The department provides detailed guidelines on how to calculate and file income tax returns, ensuring that taxpayers comply with state laws.

Sales Tax

Sales tax is applied to goods and services purchased within the state. The department offers resources to help businesses and consumers understand their sales tax responsibilities.

Resources for Taxpayers

The VA Department of Taxation offers a wealth of resources to assist taxpayers in navigating the complexities of the tax system. From online portals to customer service representatives, these resources are designed to make the process as smooth as possible.

Online Tools

- Electronic filing options for individual and business tax returns.

- Access to account information and payment history.

- Interactive calculators for estimating tax liabilities.

Customer Support

Taxpayers can reach out to the department's customer support team for assistance with any questions or issues. Whether through phone, email, or in-person visits, the department is committed to providing timely and accurate information.

Filing Process Explained

Filing taxes can be a daunting task, but the VA Department of Taxation has made the process as straightforward as possible. By following the steps outlined below, taxpayers can ensure that their filings are accurate and timely.

Step-by-Step Guide

- Gather all necessary documents, such as W-2s and 1099s.

- Use the department's online portal or paper forms to file your return.

- Double-check your calculations and ensure all information is correct.

- Submit your return by the deadline to avoid penalties.

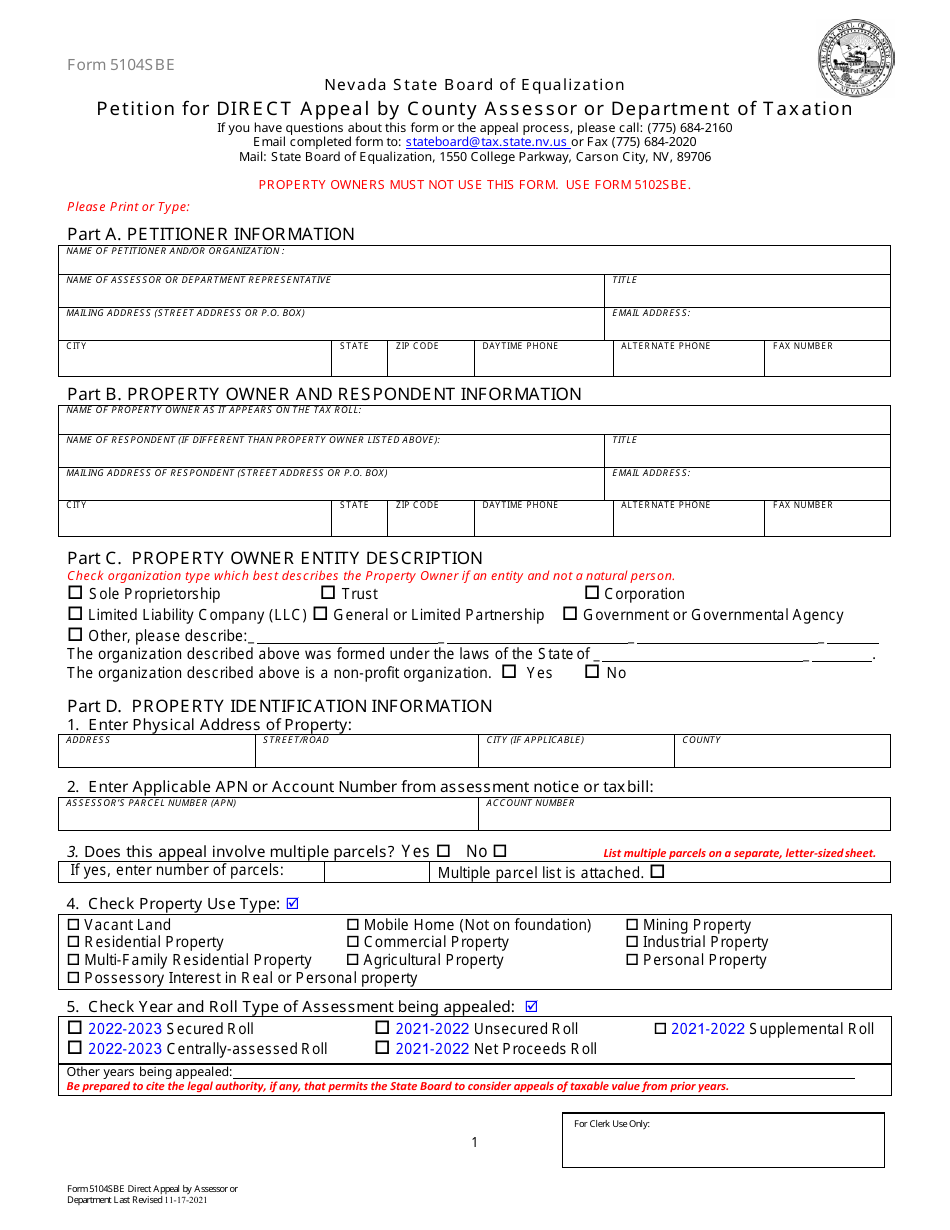

Appeals and Dispute Resolution

In the event of a disagreement with the department's assessment or decision, taxpayers have the right to appeal. The appeals process is designed to provide a fair and impartial review of the case.

Steps to File an Appeal

- Submit a written request for an appeal within the specified timeframe.

- Provide all relevant documentation to support your case.

- Attend a hearing if necessary, where both parties can present their arguments.

Understanding Tax Credits

Tax credits are an important tool for reducing the amount of tax owed. The VA Department of Taxation offers several types of credits, each with its own eligibility criteria.

Common Tax Credits

- Energy efficiency credits for homeowners.

- Education credits for students and parents.

- Business investment credits to encourage economic growth.

Common Questions Answered

Many taxpayers have questions about the VA Department of Taxation and its processes. Below are some frequently asked questions and their answers.

FAQs

- How long does it take to receive a refund?

- What should I do if I missed the filing deadline?

- Are there penalties for incorrect filings?

Future of the VA Department of Taxation

As technology continues to advance, the VA Department of Taxation is committed to staying at the forefront of innovation. By implementing cutting-edge solutions and enhancing its services, the department aims to provide an even better experience for taxpayers in the years to come.

Upcoming Initiatives

- Expansion of mobile applications for easier access to services.

- Enhanced cybersecurity measures to protect taxpayer data.

- Increased focus on taxpayer education and outreach programs.

Conclusion

In conclusion, the VA Department of Taxation is a vital component of Virginia's financial infrastructure. By understanding its functions and resources, taxpayers can ensure compliance and make the most of the available benefits. We encourage you to explore the department's website and take advantage of the tools and information provided.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore our other articles for more insights into financial and tax-related topics. Together, we can build a more informed and empowered community of taxpayers.

Data Sources: Virginia Department of Taxation, Internal Revenue Service.