In the world of banking and financial transactions, understanding terms like "Bank Transit ABA Number" is crucial for ensuring seamless operations. Whether you're a business owner, an individual managing finances, or simply someone curious about banking processes, this guide will provide you with everything you need to know. In this article, we will delve deep into what a Bank Transit ABA Number is, its significance, and how it affects your banking experience.

A Bank Transit ABA Number plays a pivotal role in the banking ecosystem, serving as a unique identifier for banks during financial transactions. It ensures that funds are routed correctly and efficiently between different financial institutions. As we navigate through this guide, you will discover how this number works and why it is indispensable in today's financial world.

By the end of this article, you will have a solid understanding of Bank Transit ABA Numbers, their applications, and how to use them effectively. Let's dive in and explore the intricacies of this essential banking tool.

Read also:Discovering Aishah Sofey A Rising Star In The Spotlight

Contents:

- Introduction to Bank Transit ABA Number

- History and Evolution of ABA Numbers

- Structure of a Bank Transit ABA Number

- Functions and Importance

- Types of ABA Numbers

- How to Find Your Bank Transit ABA Number

- Common Uses of ABA Numbers

- ABA Number Security and Protection

- Frequently Asked Questions

- Conclusion

Introduction to Bank Transit ABA Number

A Bank Transit ABA Number, often referred to simply as an ABA number, is a nine-digit code used primarily in the United States to facilitate the transfer of funds between financial institutions. This number acts as a unique identifier for each bank or credit union, ensuring that transactions are directed to the correct institution.

Why is the ABA Number Important?

The importance of a Bank Transit ABA Number cannot be overstated. It ensures that financial transactions are processed accurately and efficiently. Without it, the complex web of banking transactions could lead to confusion and errors. Here are some key reasons why ABA numbers are vital:

- Ensures accurate routing of funds.

- Facilitates direct deposits, wire transfers, and automatic payments.

- Reduces the risk of fraud by providing a standardized system.

History and Evolution of ABA Numbers

The history of ABA numbers dates back to 1910 when the American Bankers Association (ABA) developed the system to standardize banking transactions. Initially, these numbers were used to identify banks for check processing. Over the years, the system has evolved to accommodate modern financial needs, such as electronic fund transfers and automated payments.

Key Milestones in ABA Number Development

- 1910: Introduction of the ABA number system.

- 1970s: Adoption for electronic transactions.

- 2000s: Expansion to include international transactions.

Structure of a Bank Transit ABA Number

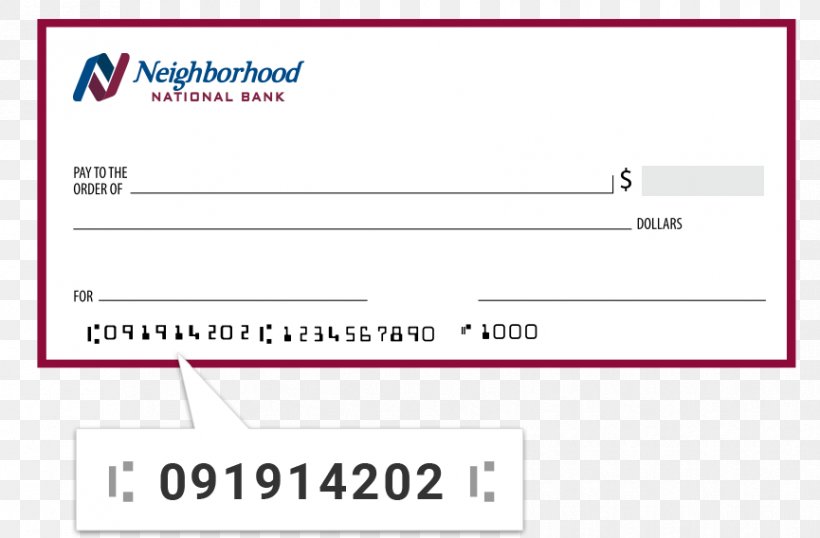

A Bank Transit ABA Number consists of nine digits, each serving a specific purpose:

- First four digits: Identifies the Federal Reserve Routing Symbol.

- Fifth and sixth digits: Represent the ABA Institution Identifier.

- Seventh digit: Indicates the Federal Reserve District.

- Last digit: Acts as a checksum to validate the number.

Understanding the Checksum

The checksum is a critical component of the ABA number. It ensures the integrity of the number by verifying its accuracy through a mathematical algorithm. This process helps prevent errors and fraud in financial transactions.

Read also:Enrica Cenzatti Age Everything You Need To Know About Her Life And Career

Functions and Importance

The primary function of a Bank Transit ABA Number is to route financial transactions accurately. Here are some of its key functions:

- Facilitating direct deposits.

- Enabling wire transfers between banks.

- Supporting automatic bill payments.

Impact on Financial Transactions

The efficiency of financial transactions is significantly enhanced by the use of ABA numbers. They reduce processing times and minimize the risk of errors, making them an indispensable tool in the banking industry.

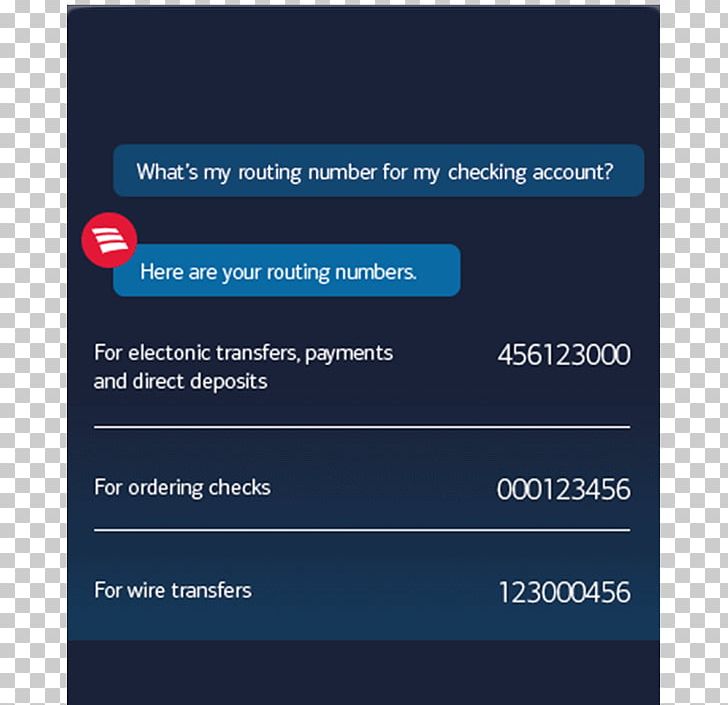

Types of ABA Numbers

There are two main types of ABA numbers:

- ACH Routing Numbers: Used for electronic transactions such as direct deposits and automatic payments.

- Wire Transfer Routing Numbers: Used for domestic and international wire transfers.

Differences Between ACH and Wire Transfer Numbers

While both types serve the purpose of routing transactions, they differ in their application and processing times. ACH numbers are typically used for smaller, recurring transactions, while wire transfer numbers are used for larger, one-time transfers.

How to Find Your Bank Transit ABA Number

Finding your Bank Transit ABA Number is straightforward. Here are some methods you can use:

- Check your checks: The ABA number is usually printed at the bottom of your checks.

- Bank website: Many banks provide ABA numbers on their official websites.

- Customer service: Contact your bank's customer service for assistance.

Tips for Locating the Correct Number

When searching for your ABA number, ensure you use the correct type for your transaction. For example, use an ACH number for direct deposits and a wire transfer number for international transactions.

Common Uses of ABA Numbers

ABA numbers are used in a variety of financial transactions, including:

- Direct deposits of paychecks.

- Automated bill payments.

- Wire transfers between accounts.

Real-World Applications

Many businesses and individuals rely on ABA numbers for their daily financial activities. For instance, employers use ABA numbers to deposit employee salaries directly into their accounts, while utility companies use them to collect payments automatically.

ABA Number Security and Protection

Protecting your Bank Transit ABA Number is essential to prevent unauthorized access and fraud. Here are some security tips:

- Keep your ABA number confidential.

- Monitor your accounts for suspicious activity.

- Use secure methods for sharing your ABA number.

Common Security Threats

Some common security threats associated with ABA numbers include phishing scams and identity theft. Being vigilant and following security best practices can help mitigate these risks.

Frequently Asked Questions

Here are some frequently asked questions about Bank Transit ABA Numbers:

What happens if I use the wrong ABA number?

Using the wrong ABA number can result in delayed or failed transactions. Always double-check the number before initiating a transaction.

Can I use the same ABA number for all transactions?

No, different transactions may require different types of ABA numbers. Ensure you use the correct number for each transaction type.

Conclusion

In conclusion, a Bank Transit ABA Number is a crucial component of the banking system, ensuring accurate and efficient financial transactions. By understanding its structure, functions, and security measures, you can make the most of this essential tool. We encourage you to share this article with others and leave a comment below if you have any questions or insights. Don't forget to explore our other informative articles on financial topics!

Sources: