Understanding financial terminology is crucial when managing your banking transactions effectively. One common question that arises is whether a routing number is the same as an ABA number. In this article, we will delve into the details, exploring what these numbers mean and how they function in the banking system.

As financial systems become increasingly digital, understanding the nuances of banking terms has become more important than ever. A routing number and an ABA number are often mentioned interchangeably, but it's essential to know their exact meanings and purposes.

This guide will provide clarity on the topic, ensuring that you have all the necessary information to handle your banking transactions confidently. Let's dive into the details and answer the question once and for all.

Read also:Discover Lucie The Ultimate Guide To Understanding And Embracing Lucie

Table of Contents

- What is a Routing Number?

- ABA Number Definition

- Difference Between Routing and ABA Numbers

- How Routing Numbers Work

- Importance of Routing Numbers

- Finding Your Routing Number

- Common Uses of Routing Numbers

- ABA Number vs. Schwab Number

- Tips for Securing Your Routing Number

- Conclusion

What is a Routing Number?

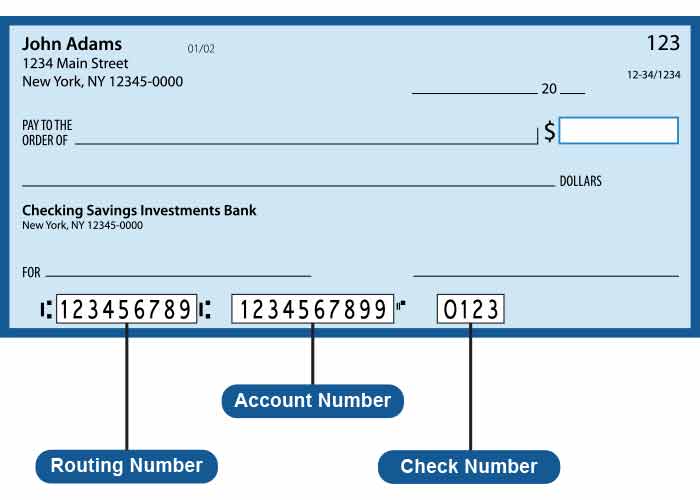

A routing number, also known as a routing transit number (RTN), is a nine-digit code used by banks and financial institutions in the United States to identify themselves during financial transactions. This number ensures that funds are routed to the correct institution. It is primarily used for domestic transactions within the U.S.

Key Points:

- Routing numbers are assigned to each financial institution by the American Bankers Association (ABA).

- They are essential for processes such as direct deposits, wire transfers, and automated clearing house (ACH) transactions.

- Each bank or credit union can have multiple routing numbers depending on the location and type of transaction.

History of Routing Numbers

Routing numbers were first introduced in 1910 by the American Bankers Association to streamline the process of check clearing. Since then, they have become an integral part of the U.S. banking system, ensuring efficient and accurate transactions.

ABA Number Definition

An ABA number refers to the same nine-digit code used to identify financial institutions. The term "ABA number" comes from the American Bankers Association, which developed and oversees the system. In essence, an ABA number is simply another name for a routing number.

Key Points:

- The ABA number is used in various financial transactions, including ACH transfers and wire transfers.

- It is a standardized system that ensures funds are transferred to the correct bank or credit union.

Role of the American Bankers Association

The American Bankers Association plays a crucial role in maintaining the integrity of the routing number system. They ensure that each financial institution is assigned a unique code, preventing confusion and errors in transactions.

Read also:Understanding Uncut A Comprehensive Guide To Its Meaning Importance And Applications

Difference Between Routing and ABA Numbers

While the terms "routing number" and "ABA number" are often used interchangeably, there is no significant difference between them. Both refer to the same nine-digit code used to identify financial institutions. However, the context in which they are used may vary.

Key Points:

- Routing numbers are commonly used in banking transactions, while ABA numbers may be more frequently mentioned in financial documentation.

- Both terms refer to the same code, ensuring seamless communication between financial institutions.

Why the Terminology Matters

Understanding the terminology is important for clarity, especially when dealing with financial institutions. While both terms refer to the same code, using the correct term in the appropriate context can help avoid confusion.

How Routing Numbers Work

Routing numbers function as a unique identifier for financial institutions, ensuring that funds are routed to the correct bank or credit union. When you initiate a transaction, such as a direct deposit or wire transfer, the routing number is used to verify the identity of the financial institution involved.

Key Points:

- Routing numbers are embedded in checks and other financial documents to facilitate accurate processing.

- They play a critical role in ensuring the security and efficiency of financial transactions.

Steps in a Routing Number Transaction

When a transaction is initiated, the routing number is verified to ensure that the correct financial institution is involved. This verification process helps prevent fraud and ensures that funds are transferred accurately.

Importance of Routing Numbers

Routing numbers are essential for maintaining the integrity and efficiency of the U.S. banking system. They ensure that financial transactions are processed accurately and securely, protecting both consumers and financial institutions.

Key Points:

- Routing numbers prevent errors in transactions by identifying the correct financial institution.

- They play a vital role in maintaining the security of financial transactions.

Impact on Financial Transactions

The presence of routing numbers has significantly improved the efficiency of financial transactions. By providing a standardized system for identifying financial institutions, routing numbers have streamlined processes such as check clearing and electronic fund transfers.

Finding Your Routing Number

Locating your routing number is a straightforward process. You can find it on your checks, in your online banking account, or by contacting your bank directly. Knowing where to find your routing number is essential for initiating transactions such as direct deposits and wire transfers.

Key Points:

- Your routing number is typically the first set of numbers printed on the bottom left corner of your checks.

- Many banks provide routing numbers in the account details section of their online banking platforms.

Verifying Your Routing Number

To ensure accuracy, it's always a good idea to verify your routing number with your bank. This can be done by contacting customer service or visiting a local branch. Verification helps prevent errors in transactions and ensures that funds are transferred to the correct institution.

Common Uses of Routing Numbers

Routing numbers are used in a variety of financial transactions, including direct deposits, wire transfers, and ACH transfers. Understanding the common uses of routing numbers can help you manage your finances more effectively.

Key Points:

- Direct deposits: Routing numbers are used to ensure that your paycheck or government benefits are deposited into the correct account.

- Wire transfers: They facilitate the transfer of funds between financial institutions, ensuring that the correct bank is involved.

- ACH transfers: Routing numbers are essential for electronic payments and bill payments.

Examples of Transactions Using Routing Numbers

Examples of transactions that use routing numbers include setting up automatic bill payments, receiving direct deposits from employers, and transferring funds between accounts at different banks.

ABA Number vs. Schwab Number

While ABA numbers are used by most financial institutions, some institutions, such as Charles Schwab, use their own numbering systems. Understanding the differences between these systems is important for ensuring accurate transactions.

Key Points:

- Charles Schwab uses a unique system for identifying accounts, which may differ from the standard ABA number format.

- It's important to confirm the correct number with your financial institution to avoid errors in transactions.

How to Confirm Your Schwab Number

To confirm your Schwab number, you can contact Charles Schwab's customer service or access your account details through their online platform. Ensuring that you have the correct number is crucial for initiating transactions successfully.

Tips for Securing Your Routing Number

Protecting your routing number is essential for maintaining the security of your financial accounts. Here are some tips for securing your routing number:

Key Points:

- Never share your routing number with untrusted sources.

- Use secure methods for transmitting your routing number, such as encrypted email or secure messaging systems.

- Regularly monitor your accounts for any suspicious activity.

Importance of Security Measures

Implementing security measures for your routing number helps protect your financial information from unauthorized access and potential fraud. By following best practices, you can ensure the safety of your financial transactions.

Conclusion

In conclusion, understanding whether a routing number is the same as an ABA number is crucial for managing your financial transactions effectively. Both terms refer to the same nine-digit code used to identify financial institutions, ensuring accurate and secure transactions.

To recap, routing numbers are essential for processes such as direct deposits, wire transfers, and ACH transactions. They play a vital role in maintaining the integrity and efficiency of the U.S. banking system.

We encourage you to share this article with others who may benefit from this information. If you have any questions or comments, feel free to leave them below. For more insights into financial topics, explore our other articles on the site.